MEETING OUR INVESTORS NEEDS

Volta’s mission is to deliver both strategic and financial returns for its investors by identifying, validating, and buying into the most impactful energy storage technology. Volta’s scope spans from new materials to integration hardware and software.

VOLTA’S INVESTMENT STRATEGY

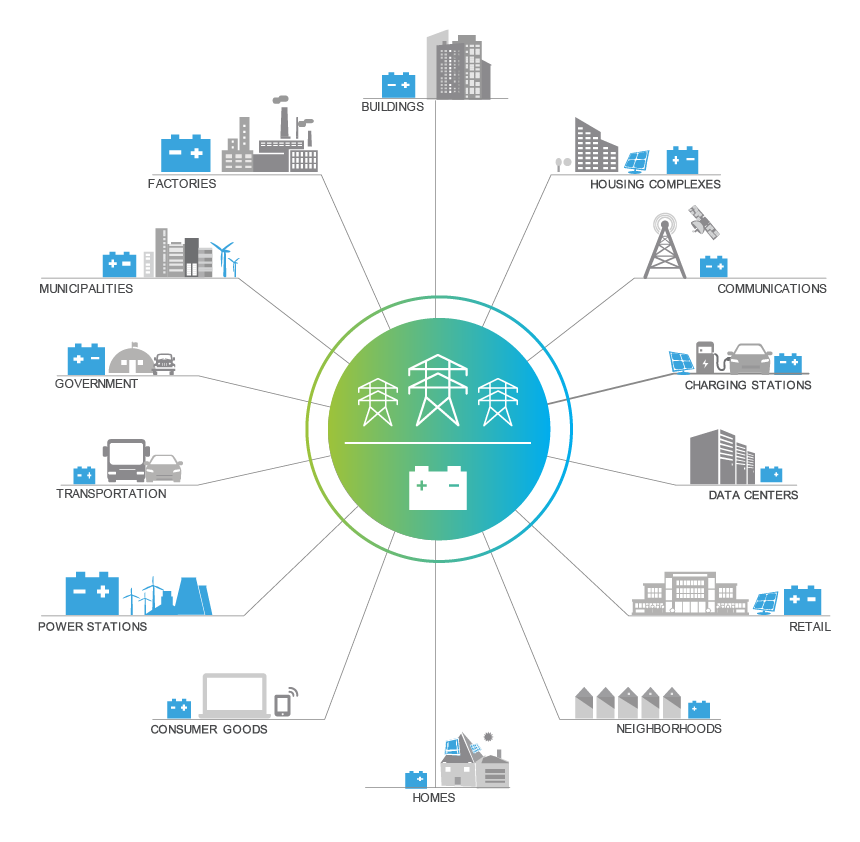

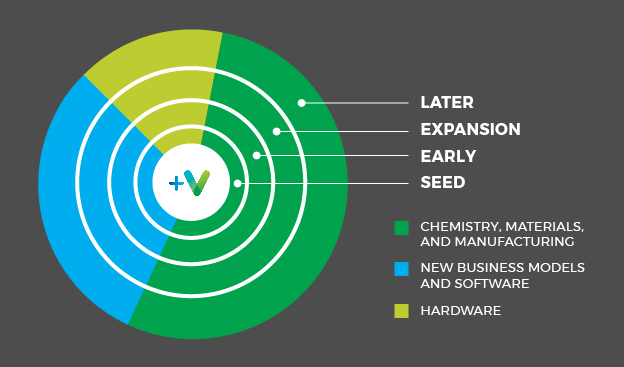

Batteries and energy storage, interconnected and in multiple applications, are central to the energy system of the future. Volta’s scope includes any hardware, software, materials, or manufacturing process that enable the ubiquitous adoption of batteries for electric vehicles and storage for renewable power generation. Volta manages a portfolio of technology investments across technology categories and maturity stages to balance risk and maximize impact.

VOLTA’S TECHNOLOGY CATEGORIES

The potential disruptors in the fast-growing energy markets for consumer electronics, electric mobility, and electric utility services will be in the categories of:

-

Chemistry, Materials, and Manufacturing: Solid state electrolytes, protected lithium metal, advanced flow battery technologies, materials technology enabling safety, high speed efficient materials production, and cell assembly

-

Hardware: Wireless and high speed charging equipment, sensors, next generation inverters

-

New Business Models: New applications, system integrators, storage as a service

INVESTOR ENGAGEMENT

Each Volta strategic investor participates in a working group that meets regularly to discuss the opportunities in Volta’s pipeline. Volta prioritizes its efforts based on the feedback from this group to ensure we are squarely focused on investors’ strategic and financial needs.

Investors can individually choose whether to invest in each opportunity based on the outcome of Volta’s deep diligence process. Volta’s strategic investors also govern Volta’s operation through its Board of Directors.